By now you’ve likely uncovered the main advantages of obtaining an unexpected emergency or rainy-day fund. Obtaining some cash put aside gives you outstanding satisfaction, as you realize that in case you shed a position or your vehicle breaks down, you won’t turn out in financial debt.

It is wise to refer to with a tax advisor if you have any questions on no matter if any withdrawals you make out of your 401(k) will involve a penalty in addition to taxes.

Check out our property obtaining hubGet pre-approved to get a mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs purchase calculatorHow A lot can I borrow mortgage loan calculatorInspections and appraisalsMortgage lender evaluations

If anyone helps make a suggestion on your house out of your blue, be careful. Often these people are counting on you not realizing your assets's value and will present merely a portion of its well worth.

In case you’re withdrawing pre-tax funds, you’ll continue to pay taxes on your own 401(k) withdrawal; but for those who’re withdrawing Roth funds, you may not should pay out taxes on your contributions

Most plans make it possible for contributors to take any rollover source for a distribution (like funds Earlier rolled to the program from A different certified prepare or IRA) Anytime, but using this amount in cash in advance of age fifty nine ½ may well bring about a 10% penalty.

Pamela de la Fuente will be the assigning editor on NerdWallet's taxes vertical. Her workforce covers tax brackets and rates, profits tax submitting and tax-advantaged retirement accounts, between other subject areas. She is a author and editor for much more than 20 years.

At NerdWallet, our material goes via get more info a rigorous editorial evaluate approach. We've these types of self confidence in our correct and useful information that we let exterior experts inspect our operate.

Examining account guideBest examining accountsBest absolutely free examining accountsBest on the internet check accountsChecking account options

The second most crucial mentality shift goes from progress to revenue projection. It is now time to stop thinking about your nest egg as a considerable number and begin inquiring how much money it will make the working day you allow your position. Will your nest egg be capable to create the money you require? For just how long?

The investing information furnished on this webpage is for educational reasons only. NerdWallet, Inc. will not present advisory or brokerage providers, nor does it propose or suggest traders to obtain or market individual stocks, securities or other investments.

A lot of or most of the products featured Allow me to share from our companions who compensate us. This influences which products and solutions we write about and in which And the way the product or service appears on the website page.

After you are matched by using a lender, and also your financial loan is accepted, the curiosity premiums and costs that you will incur for the duration of repayment are going to be furnished to you.

The strategic depth of retirement organizing deepens with the option to transform a conventional IRA into a Roth IRA. By turning tax-deferred price savings into tax-free withdrawals, a profit which can pay back dividends properly into your retirement many years.

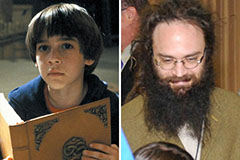

Barret Oliver Then & Now!

Barret Oliver Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!